net investment income tax 2021 calculator

To calculate the NIIT lets first look at the statutory threshold amounts. Married filing jointly 250000 Married filing separately 125000 Single or head of household 200000 or.

2021 Estate Income Tax Calculator Rates

Local income tax rates that do not apply to investment income or gains are not included.

. Apr 15 2021. This is your personal tax-free allowance. Overview Data and Policy Options Since 2013 certain higher-income individuals have been subject to a 38 unearned income Medicare contribution tax more commonly referred to as the net investment income tax NIIT.

Your additional tax would be 1140 038. For example- for the financial year 2021-22 the net taxable income is Rs 1200000 and the total tax payable is Rs 119000. If your net investment income is 1 or more Form 8960 helps you calculate the NIIT you owe by multiplying the amount by which your MAGI exceeds the applicable threshold or your net investment incomewhichever is the smaller figureby 38 percent.

1 2013 individual taxpayers are liable for a 38 percent Net Investment Income Tax on the lesser of their net investment income or the amount by which their modified adjusted gross income exceeds the statutory threshold amount based on their filing status. Your net investment income is less than your MAGI overage. In general net investment income for purpose of this tax includes but isnt limited to.

The formula for calculating tax percentage is total tax payable divided by the total net taxable income for the financial year. Income taxes in Scotland are different. Because your income is now 25000 past the threshold and that number is the lesser of 75000 your total net investment income then you would owe taxes on that 25000.

If an individual has income from investments the individual may be subject to net investment income tax. The tax rate on most net capital gain is no higher than 15 for most individuals. An additional Medicare tax of 09 also applies to earned income subject to employment taxes.

2021 tax rate for single filers for married individuals filing joint returns for heads of households. Income up to 12570 - 0 income tax. The statutory authority for the tax is.

However you also have 75000 in net investment income from capital gains rental income and dividends which pushes your total income to 275000. Once you are above these income amounts the Net Investment Income Tax goes into effect. The net investment income tax NIIT is a 38 tax on investment income such as capital gains dividends and rental property income.

April 28 2021 The 38 Net Investment Income Tax. You then enter your NIIT liability on the appropriate line of your tax form and file Form. Ad Fisher Investments new retirement calculator morefree after creating a secure profile.

This is the detailed computation of the Net Investment Income Tax which is regulated by section 1411 of the Internal Revenue CodeWe earlier published easy NIIT calculatorAs you know the net investment income of individuals estates and trusts is taxed at the rate of 38 provided they have income above the statutory threshold amounts. These rates are applicable for the assessment year 2022-23 during which taxes for the year 2021-22 are determined. Youll owe the 38 tax.

This tax only applies to high-income taxpayers such as single filers who make more than 200000 and married couples who make more than 250000 as well as certain estates and trusts. The adjusted gross income over the dollar amount at which the highest tax bracket begins for an estate or trust for the tax year. The net investment income tax applies to taxpayers who have a significant amount of investment income typically high-net-worth families and individuals with considerable assets.

2021-12-17 Since January 1 2013 a 38 Medicare tax known formally as the Net Investment Income Tax NIIT aka Medicare surtax applies to certain investment income of individuals estates and trusts that exceed statutory threshold amounts. In 2021 and 2022 the capital gains tax rates are either 0 15 or 20 on most assets held for more than a year. Undistributed net investment income or the amount of adjusted gross income that exceeds the highest tax bracket of 12950 for 2020 and 13050 for 2021.

Qualifying widow er with a child 250000. Advanced retirement calculator and much more. Ad Estimate Your Taxes and Refunds Easily With This Free Tax Calculator from AARP.

For more information on the Net Investment Income Tax refer to Tax filing FAQ. Income tax calculator 2022-23 2021-22 and 2020-21. Lets say you have 30000 in net investment income and your MAGI goes over the threshold by 50000.

Capital gains tax rates on most assets held for less than a year correspond to. These income tax bands apply to England Wales and Northern Ireland for the 2022-23 2021-22 and 2020-21 tax years. All other threshold amounts are not indexed for.

Some or all net capital gain may be taxed at 0 if your taxable income is less than or equal to 40400 for single or 80800 for married filing jointly or qualifying widower. Enter Your Status Income Deductions and Credits and Estimate Your Total Taxes. Given the complexity of the 38 tax if this tax is applicable for you based on the guidelines above we encourage you to work with a qualified tax professional to understand how it may impact your specific situation and to address your questions.

Limit iras with large balances. But youll only owe it on the 30000 of investment income you havesince its less than your MAGI overage. Additionally health and education cess at 4 are levied on the total tax rate above the total amount payable.

Find out more in our guide to income taxes in Scotland. 250000 for married filing jointly. Fisher Investments Retirement GPS.

Capital Gain Tax Rates. For estates and trusts the 2021 threshold is 13050 Definition of Net Investment Income and Modified Adjusted Gross Income. The 38 Net Investment Income NII federal tax applies to individuals estates and trusts with modified adjusted gross income MAGI above applicable threshold amounts 200000 for single and head of household.

1031 Capital Gains Calculator 1031 Exchanges Ipx1031

How To Calculate The Net Investment Income Properly

How To Calculate The Net Investment Income Properly

How To Calculate The Net Investment Income Properly

Tax Calculator Estimate Your Income Tax For 2021 And 2022 Free

2021 Capital Gains Tax Rates How They Apply Tips To Minimize What You Owe

What Is The The Net Investment Income Tax Niit Forbes Advisor

How To Calculate Your Profit In 2021 When Selling Your Rental Property Mortgage Blog

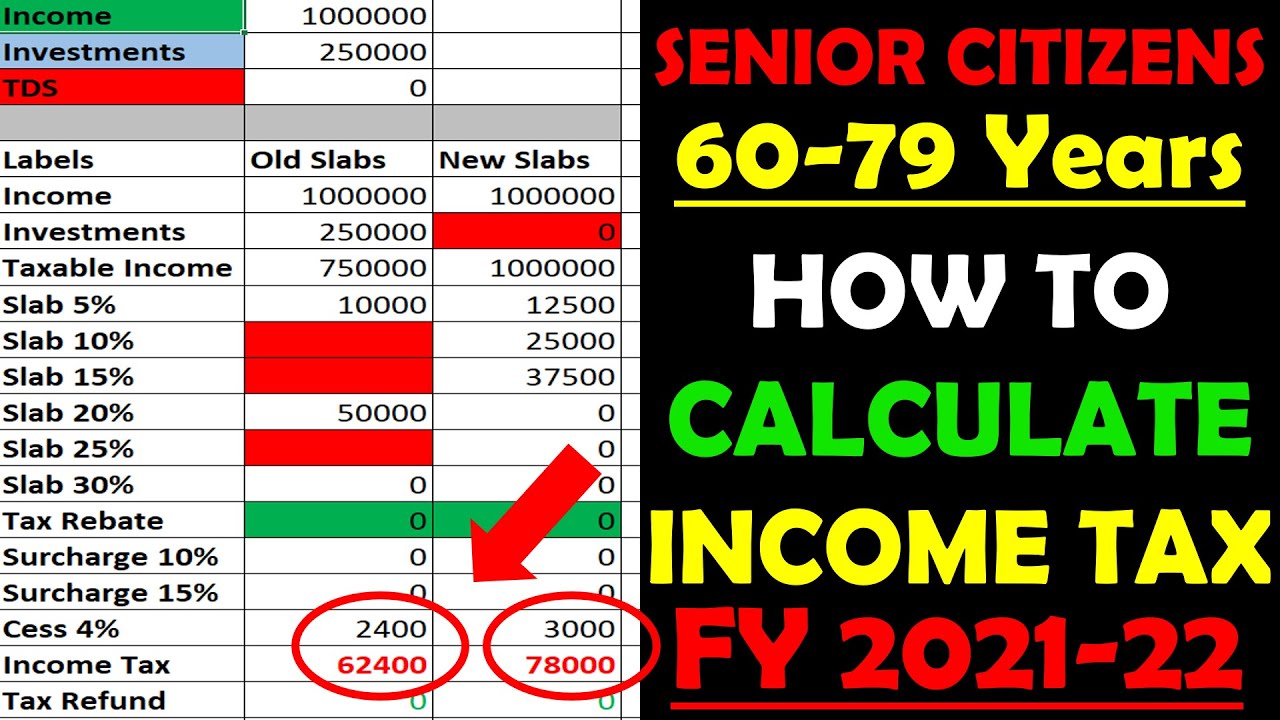

How To Calculate Income Tax Fy 2021 22 Excel Examples Senior Citizens Age 60 To 79 Years Youtube

Tax Calculator Estimate Your Income Tax For 2021 And 2022 Free

How To Calculate Income Tax Fy 2021 22 New Tax Slabs Rebate Income Tax Calculation 2021 22 Youtube

2021 Capital Gains Tax Rates How They Apply Tips To Minimize What You Owe

The 2022 Capital Gains Tax Rate Thresholds Are Out What Rate Will You Pay

Capital Gains Tax What Is It When Do You Pay It

2021 Capital Gains Tax Rates How They Apply Tips To Minimize What You Owe

Tax Calculator Figure Your 2021 Irs Refund Before Filing Your Return

/dotdash_Final_Deferred_Tax_Asset_Definition_Aug_2020-01-dab264b336b94f939b132c55c018f125.jpg)